Non-Dilutive Capital in Scaling Early-Stage Mobility Startups

MIT Mobility Initiative Research Briefing

February, 2025

Laura Fox

Executive Summary

This briefing explores the critical role that non-dilutive capital sources (like debt and grants) play in scaling early-stage urban mobility climate startups.

Efficient sources and uses of capital is always important, but especially now: private equity markets have been constrained over the last three years due to lack of exits and low liquidity overall, and recent federal changes are aimed at reducing government tailwinds for the overall climate market.

2024 was the first year in which average global temperatures at the surface of the planet exceeded 1.5C above pre-industrial levels, a level tied to increasing likelihood of climate-driven natural disasters.

Now is not the time to repeat the failures of Clean Tech 1.0, in which venture investors invested $25B in hard tech companies, lost half of their money, and climate tech’s share of overall industry investment declined from 8% to 3% in less than a decade (between 2008 to 2016).

A dominant problem in the Clean Tech 1.0 phase was the primary reliance on equity-based investment structures (Bessemer, MIT), rather than a more comprehensive approach to the capital stack that looks to structure equity alongside non-dilutive capital sources like grants, debt, and other financing structures.

To create a practical guide for founders on how to navigate the evolving financial ecosystem, this research included four key measures: conducting founder interviews, hosting events, sourcing insights from across the mobility ecosystem (investors, program managers, incubators and accelerators, etc.), and conducting desktop research. The outcomes and key insights include frameworks and resources on areas including overall capital management, capital options based on company maturity, public catalog of non-dilutive resources, process resources and insights, and more.

As a next step, hands-on workshops will be held on three critical non-dilutive funding streams for early-stage founders: deployment grants to de-risk debt capital, equipment financing to scale asset deployments, and project financing (for both pre-construction and construction).

Background & Motivation

Transportation is the largest source of GHG emissions in the United States – representing 29% of total emissions. It’s also the fastest growing source of emissions, with 80% growth from 1990-present.

At the very moment that we need to scale innovative, emissions-reducing transportation and mobility startups to solve these issues, startups are experiencing some of the most difficult equity fundraising environments. Some key insights for mobility startups:

-

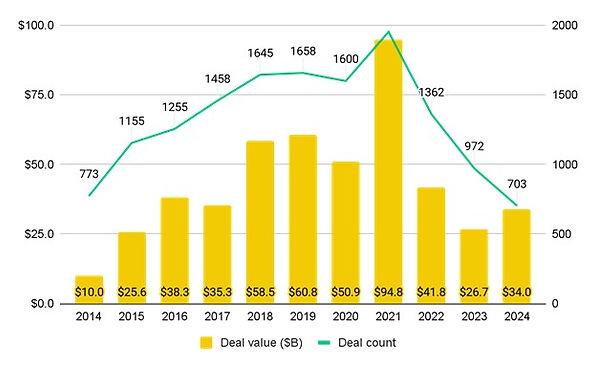

Mobility deal values are down 64% from the height of the market in 2021, and deal counts are down 64% (Figure 1). Excluding five “mega deals” in Q4 2024 that drove $9B of deal value (Waymo, AVATR, IM Motors, BETA Technologies, and Didi Autonomous), deal values would be down nearly 74%.

-

Mobility exits, which drive liquidity and fresh capital into the market, are down 85-90% from 2021 (Figure 2)

-

Time between mobility equity funding rounds has increased 40-50% since 2021 (Figure 3), creating significant pressure on founders to extend runways (e.g., the time before a company rounds out of capital to sustain itself)

-

As a result of tepid equity markets, debt/equity ratios for mobility startups have risen across stages (Figure 4), most pronounced at Seed (4X) and Series A (5X) and Series B (40%)

Figure 1: Global mobility deal counts and value, 2014-2024. Pitchbook mobility data, retrieved February 2025. Streetlife Ventures analysis.

Figure 2: Global mobility exits and value, 2014-2024. Pitchbook mobility data, retrieved February 2025. Streetlife Ventures analysis.

Figure 3: Median time between U.S. mobility deal rounds, 2014-2024. Pitchbook mobility data, retrieved February 2025. Streetlife Ventures analysis.

Figure 4: Median debt/equity ratios for U.S. Mobility startups, 2014-2024. Pitchbook mobility data, retrieved February 2025. Streetlife Ventures analysis.

Research approach

The research approach for this work included five key methods:

-

Interviewed 15 founders on uses of capital

-

Actively sourced (emails, LinkedIn posts, etc.) referrals of best non-dilutive capital funding sources for early-stage founders (30+ emails / interactions)

-

Hosted three events focused on non-dilutive funding for founders, with partners including SOSV, NYCEDC, Elemental Impact, Autodesk Foundation, and more

-

Attended ~10 deep dive sessions led by non-dilutive funding experts in this space, including Spring Lane Capital’s Dev U program, Enduring Planet’s capital series, and more

-

Conducted desktop research on state of the market, existing ecosystem resources and guides, and more

Key results & takeaway messages

Founders understanding sources and uses of capital earlier is a good thing -

Interviewees highlighted a bright spot in these equity market trends: founders understanding different capital sources earlier is a good thing, as it directly impacts the health of their company long-term and their own ownership shares (and avoids the failures of Clean Tech 1.0).

Figure 5 below demonstrates an example “sources and uses of capital” framework for founders. This framework will be different for every company based on type (software, hardware, revenue model, etc.), but this example features 1) an approach for a mobility startup with physical assets and project needs and 2) the associated costs of that form of capital (e.g., the return expected by investors of that capital). Outside of equity, all other forms of capital are non-dilutive, meaning that they allow founders to receive capital without giving up equity or ownership in the company.

As a brief summary of these funding mechanisms for founders:

-

Equity - Dilutive. Equity is the most expensive form of capital, and should be used for activities that can’t be financed in other ways (e.g., hardware development, software development, early sales & marketing activities, etc.).

-

Debt - Non-Dilutive. Significant range of debt options (detailed in Figure 8) that can be leveraged to finance project installations, assets and equipment purchases, working capital needs, and more. Typically require a commercially-ready product in place in order to underwrite.

-

Grants - Non-Dilutive. Grants are “free money” but typically require significant staff time (e.g., writing applications, reporting on project outcomes, etc.). Grants can be used for a range of purposes, including to reduce equity needs (e.g., help fund R&D), receive early deployment funding before metrics are in place to successfully raise debt, fund expansion to low- and moderate-income (LMI) communities, and more.

-

Revenue - Non-Dilutive. As a company scales, its revenue growth replaces equity needs, reducing future dilution for founders.

Figure 5: Illustrative framework of approach to sources and uses for early-stage mobility founders.

These forms of capital are not immediately (or simultaneously) available to a founder, and become relevant (or irrelevant) at different stages of a company’s growth and development. Figure 6 below highlights a simplified journey for founders to bring in these different forms of capital. At each step a founder will:

-

Step 1 - source R&D grants to conduct customer research and develop an early prototype of their product

-

Step 2 - continue to source R&D grants, and raise first round of equity funding based on early product prototype and customer findings

-

Step 3 - raise first deployment grant to install first product(s) in the real world, and continue equity funding based on beta product deployments and learnings

-

Step 4 - with a commercially tested and viable product, continue to raise equity funding and deployments grants (likely now for deployments that would otherwise not be market rate, like within low- to moderate-income communities), and raise first debt capital for subsequent commercial units

-

Step 5 - with ramp up of revenue from sales, reduce equity needs to meet remaining cash flow gaps, and deploy debt capital for all product deployments

Figure 6: Illustrative examples of funding journey followed by healthy new IP hardware startups.

Founders today experience pain points in securing these forms of non-dilutive capital -

The above description of sources and uses of capital and illustrative journey may make the process of sourcing non-dilutive capital sound simple. It’s not, especially for early-stage founders. In interviews, early-stage founders emphasized three critical pain points that they experience in securing non-dilutive capital:

-

Practical, public listings of capital options and providers do not exist

-

Processes for raising early-stage debt are complicated and unclear, and there’s no readily-available “checklist” for an early-stage debt data room

-

Strong case studies don’t exist, so founders need to source conversations with other founders just to understand the basics (e.g., pros / cons, watchouts, etc.). This will be addressed in more depth in live webinars sessions hosted by Streetlife Ventures and the MIT Mobility Institute, and scheduled for Q2 2025.

A) Making the Option Set Clearer

To institutionalize that knowledge and build on it with referrals from founders, investors, and other ecosystem players, we created – in partnership with SOSV, NYCEDC, and other VC partners – a guide for early-stage climate founders (including mobility) with a critical focus on non-dilutive resources.

At the early stages (Seed, Series A), founders don’t typically qualify for loans from larger banks like JP Morgan, Bank of America, Goldman Sachs, Morgan Stanley, or other financial firms well-known for providing debt capital. Instead, there are a range of both established providers (like Green Banks, local government incentive programs), impact firms (like Candide’s Climate Justice Fund), and emerging private credit firms (like Enduring Planet, Ezra Climate) for early-stage non-dilutive capital

Video 1: Walk through of Streetlife Ventures’ public listing of non-dilutive capital resources for early-stage founders.

For debt capital in particular, there are a range of types based on the capital need and the company’s stage / maturity. Figure 7 below highlights seven types of debt capital, and illustrative rates, complexity, and relevant stages.

Figure 7: Example types of debt capital for founders, with illustrative WACC, complexity, and stage notes. Note that Weighted Average Cost of Capital (WACC) rates are highly dependent on Prime rates, and founders should check with debt providers for the latest rates.

From past experience and research interviews, early-stage climate mobility founders most often seek three forms of debt capital:

-

Project financing - underwrites pre-construction and constructions for projects (e.g., the install of the curbside EV charger), with core underwriting criteria including the project itself (technology, warranties, contracts, regulations), financial health of the borrower (credit history, financial statements, project-specific financial model), operations implementation (e.g., EPC / contractor diligence), etc.

-

Receivable financing - underwrites accounts receivables gaps (e.g., gap between customer order and payment), with core underwriting criteria including the goods’ gross margin (most capital providers stipulated >50% gross margin requirements), credit history, financial statements, etc.

-

Equipment financing - underwrites assets (e.g., bike, scooter, EV vehicle / truck), with core underwriting criteria including credit history, equipment details (useful life of the asset, resale value), signed contracts (essentially guaranteed revenue), financial statements, etc.

B) Clarifying the process

Given the size of pain point around understanding processes and requirements for this funding, a survey was conducted of existing resources by type of non-dilutive capital, with the strongest resources for mobility founders listed below.

The below resources are grouped by type:

Overview:

-

Streetlife Ventures Insider’s Guide to Non-Dilutive Funding Sources for U.S.-based founders

-

CTVC The Sophisticating Climate Capital Stack and The Bridge to Bankability

Grants (public + private) / Catalytic Capital:

-

Elemental Excelerator A Founder’s Guide to Government Grants

-

Catalytic Capital Consortium Introductory Resources on Catalytic Capital

-

Streamline Climate Guide to Applying for Grants (and ROI)

-

Climate Finance Solutions Funding Your Journey with Grants

-

Elemental Excelerator D-SAFE

-

Enduring Planet Insights

-

US White House’s Climate Capital Guidebook

Early-stage project finance

-

Planet A Ventures Project Finance Template

-

New Energy Nexus, Lessons Learned from Climate Tech Project Finance

-

Project Finance in Renewable Energy: Sensitivity Analysis and Valuation

-

Perl Street Financial Readiness Levels Playbook

-

Trellis Climate Resources for FOAK Project Preparation

Asset / equipment finance

-

Equipment Leasing and Finance Foundation Climate Finance: A Massive Commercial Opportunity for Equipment Finance

To call out a specific firm for their in-depth work in this space: Spring Lane Capita l– in partnership with CREO – also runs a successful Developer U session, a two-day workshop for CEOs and senior executives to learn skills and strategies for project development and project finance. As part of that work, they review principles, EPC and O&M contracting, and tactical processes and next steps (including a checklist for a project finance data room illustrated below in Figure 8).

Figure 8: Spring Lane Capital’s checklist for a project finance dataroom, to prepare for fundraising discussions.

Conclusion

Scaling urban mobility climate startups is essential to reducing U.S. and global emissions, and dependent on founders (and investors) having a strong understanding of different non-dilutive capital sources, processes, and practical deployment next steps.

Ultimately, the goal of this work is to support the broader urban mobility climate startup ecosystem to deploy better, faster, and in ways that drive long-term success–as strong economic management is essential to viable impact strategies.

References

New York Times, 2024 Brought the World to a Dangerous Warming Threshold. Now What?, January 2025

MIT Technology Review, Climate tech is back - and this time it can’t afford to fail, December 2023

Bessemer Venture Partners, Eight Lessons from the first climate tech boom and bust, November 2022.

MIT Energy Initiative, Venture Capital and Cleantech: The Wrong Model for Clean Energy Innovation, July 2016.

EPA, Sources of Greenhouse Gas Emissions, retrieved 2024.

ClimateWatch Data, retrieved 2024.

Pitchbook mobility data, retrieved October 2024. Streetlife Ventures analysis.

Extantia Capital, Climate Tech Capital Stack, 2024.

S2G Ventures, Financing Pathways for Climate Tech, 2023.

Spring Lane Capital’s Developer U workshop, Debt Fundraising Checklist, June 2024.